You know that thing you know you really should do, but you just keep putting off? Maybe it’s backing up the files on your computer, or putting irreplaceable documents into a safety deposit box. You never seem to get around to taking that preventative step, yet you know that if anything ever happened you would deeply regret it. Perhaps you even have an entire list of tasks like this that you’re planning to get to “one of these days”.

You know that thing you know you really should do, but you just keep putting off? Maybe it’s backing up the files on your computer, or putting irreplaceable documents into a safety deposit box. You never seem to get around to taking that preventative step, yet you know that if anything ever happened you would deeply regret it. Perhaps you even have an entire list of tasks like this that you’re planning to get to “one of these days”.

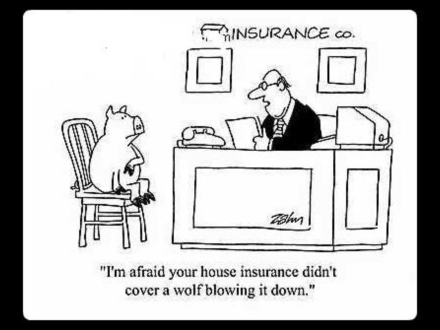

Well, add this one to your list, and put it at the top: Document your personal property for insurance purposes. Most people have heard this tip, but very few people actually take the time to do it. That’s unfortunate, because in the event of a burglary or fire, if you didn’t document the contents of your home ahead of time, the insurance claim process will be much more difficult. Save yourself the headache and the heartache–before anything happens, set aside a few hours some weekend and take inventory, including photos, videos, and a written list. Then store it all in a safe location away from your home, such as that safety deposit box you’re going to get.

With digital photography this process can be easier than ever before. Use a digital camera and take pictures of every room in your home, including inside drawers, cabinets, and closets. Don’t forget the art on the walls, the lights on the ceiling, and the carpet on the floors. Take pictures of the inside of bathroom cabinets, tool boxes, and the garden shed. Be sure to photograph appliances, curtains, bathroom fixtures, bedding, and computer equipment. Even everyday items are more valuable than you might think. Imagine the cost of replacing all the things you use on a regular basis, like furniture, kitchen items, bedding, and clothes. You get the idea: photograph everything.

You can also use video to document your possessions. The best way to do this is to start at the front of your home and work your way through each room. Narrate as you go along, explaining what each item is and making a note of any valuable items like jewelry and electronics, including the value or price paid if you know it.

Then you can simply save the images and/or video on a CD, DVD, or other storage device that you put in the safety deposit box, along with copies or originals of important documents and a written list of anything that might be helpful when filing a claim. You can also save your photos and video remotely in the cloud for additional backup. Having the images stored in more than one place will give you additional peace of mind. And as a bonus, you can back up your family photographs to the same cloud-based site. After all, photos are one thing home insurance can never replace if you don’t have copies saved elsewhere.

Imagine how much better you’ll feel after you knock this task off your “really-should-do” list. Consult with your homeowners insurance agent for more advice about documenting your belongings, and to discuss ways to ensure future home insurance claims, if any, go as smoothly as possible.